Overview

In the financial year 2021-22, the Company’s revenue increase by 32.07% from INR 80,297 Lakh to INR 106,052 Lakh.

Financials

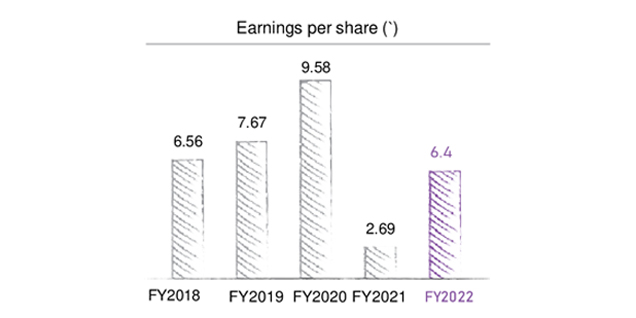

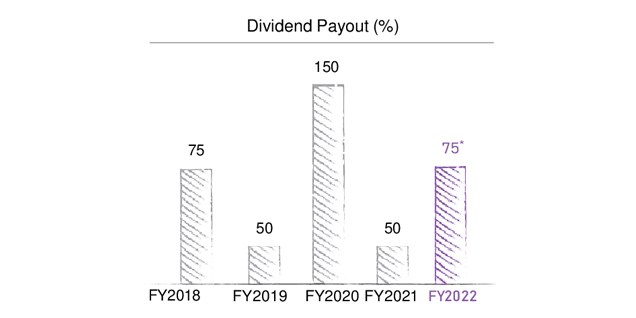

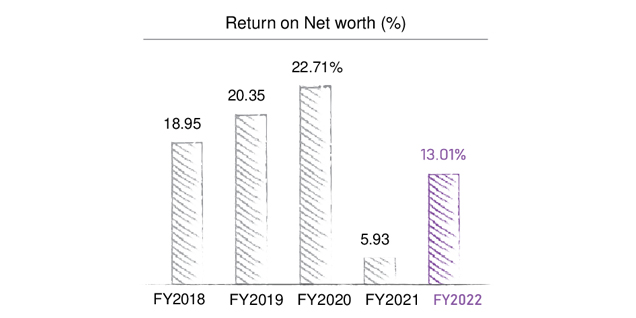

We believe in being transparent with all our stakeholders and sharing correct data year by year so that you can partner in our growth story. Here are 5 Years Financial Highlights – Standalone (INR in Lacs).

Shareholding Pattern

We owe our success to our team members and stakeholders who have invested their faith in us as a corporate entity with immense growth potential.

Corporate Governance

Built on the pillars of transparency, accountability and security, the Corporate Governance facilitates effective, entrepreneurial, and prudent management for us that ensures long-term success.

5-Year financial highlights – Standalone (in INR lacs)

| # | 2021-22 | 2020-21 | 2019-20 | 2018-19 | 2017-18 |

|---|---|---|---|---|---|

| Revenue | 108,071 | 81749 | 146,719 | 137,992 | 116,145 |

| PBDIT | 19,035 | 12585 | 34,351 | 30,703 | 26,392 |

| Interest | 368 | 684 | 1,307 | 1186 | 597 |

| PBDT | 18,667 | 11901 | 33,044 | 29,517 | 25,794 |

| Depreciation | 3,270 | 3473 | 3,529 | 2,446 | 2,349 |

| PBT | 15,397 | 8428 | 29,514 | 27,071 | 23,445 |

| Tax | 5,315 | 2265 | 7,579 | 9,324 | 8,124 |

| PAT | 14,662 | 6163 | 21,935 | 17,747 | 15,322 |

| PAT Margin(%) | 9.51 | 8.16 | 16.39 | 13.04 | 13.53 |

| No. Equity Shares | 226,213,181 | 228,870,500 | 228,870,500 | 228,870,500 | 233,558,000 |

| Equity Capital | 4,524 | 4,577 | 4,577 | 4,577 | 4,671 |

| Book Value | 49.83 | 45.4 | 42.2 | 38.1 | 34.6 |

| Dividend | 3,393 | 2,289 | 6,866 | 2,289 | 3,503 |

| Dividend(%) | 75 | 100 | 150 | 50 | 75 |

| Dividend Payout % to Net Profits | 23.1 | 44.7 | 37.7 | 15.5 | 27.5 |

| Reserves & Surplus | 108,190 | 99,309 | 91,995 | 82,619 | 76,170 |

| Gross Block | 56,280 | 54100 | 52,196 | 44,372 | 43,193 |

| Net Block | 20,487 | 21675 | 22,127 | 18,698 | 17,724 |

| Net Worth | 112,339 | 103,887 | 96,572 | 87,196 | 80,841 |

| Return on Net Worth(%) | 0.13 | 5.9 | 22.7 | 20.4 | 19.0 |

| EPS (Pre-Tax) (Rs. 2 /- per share) | 6.8 | 3.7 | 12.9 | 11.8 | 10 |

| EPS (Post Tax) (Rs. 2 /- per share) | 6.5 | 2.7 | 9.6 | 7.7 | 6.6 |

| CEPS (Pre-Tax) (Rs. 2 /- per share) | 8.3 | 5.2 | 14.4 | 12.8 | 11.0 |

| CEPS (Post Tax) (Rs. 2 /- per share) | 7.9 | 4.2 | 11.1 | 8.7 | 7.6 |

SHARE PRICES

| FY | High(₹) | Low (₹) |

|---|---|---|

| 2020 - 2021 | 121.55 | 72.70 |

| 2019 - 2020 | 119.50 | 87.00 |

| 2018 - 2019 | 158.35 | 99.15 |

| 2017 - 2018 | 193.60 | 127.75 |

| 2016 - 2017 | 174.70 | 82.05 |

| 2015 - 2016 | 113.90 | 76.10 |

| 2014 - 2015 | 119.7 | 57.00 |

Demat

99.09% of the total paid up share capital has been demated until 30th June, 2022.

Paid-Up Equity Shares: 22,62,13,181 Equity Shares of Rs. 2/- each as on 30th June, 2022.

36th Annual General Meeting:

Date & Time : Monday, 8th August, 2022 | 11:00AM (IST)

Venue : Virtual AGM through Video Conference / Other Audio Visual Means

Dividend paid in the last 5 years

| Year | Dividend | Details |

|---|---|---|

| 2021 - 2022 | Final Dividend | 75% |

| 2020 - 2021 | Final Dividend | 50% |

| 2019 - 2020 | 2nd Interim Dividend | 25% |

| 2019 - 2020 | Interim Dividend | 125% |

| 2018 - 2019 | Final Dividend | 50% |

| 2017 - 2018 | Final Dividend | 75% |

NSE

BSE

Investors Contact

Company Secretary – Amit Buch

Secretarial Department – Chetan Desai

Nodal Officer – Amit Buch

Email id: investors@navneet.com

Registrar & Share Transfer Agent:

MUFG Intime India Private Limited (Formerly Link Intime India Private Limited)

C-101, 247 Park,

LBS Marg, Vikhroli (West),

Mumbai- 400083

Tel. No. 810 811 6767

Note – To raise an email query, following is the link

https://web.in.mpms.mufg.com/Helpdesk/Service_Request.html

Website – www.in.mpms.mufg.com